How To Find a Mutual Fund Scheme’s NAV Trend Using The Best Mutual Fund Software in India?

Most investors today don’t just ask: “What is the NAV today?” They also ask, 'How has the NAV moved over time?' Was the fund very volatile? Did it fall sharply during market corrections? Has it grown steadily or in sudden jumps? And is the fund recovering after a market fall?

To answer these questions confidently, you need NAV trend analysis, not just the latest NAV value. And the best part? You don’t need Excel sheets or manual charts anymore.

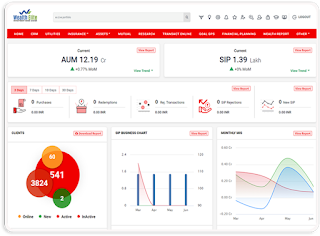

The NAV Finder inside the best mutual fund software in India lets you: select any scheme, choose any date range, and instantly see the graphical NAV trend

You get a clear picture in seconds with REDVision Technologies. Let’s see how it works.

What is an NAV Trend?

NAV trend simply shows how the NAV has changed over time. It helps you understand:

● growth journey of the fund

● ups and downs in different market phases

● long-term direction of performance

● whether returns were smooth or volatile

Instead of just seeing one number, you see the entire movement. And visually, trends are easier to understand for both you and your investors.

How NAV Finder Helps

NAV Finder allows you to:

● search any mutual fund scheme

● select custom dates

● generate historical NAV data

● View NAV movement through charts or tables

You can study NAV patterns over:

● 6 months

● 1 year

● 3 years

● 5 years

● or any custom date range you choose

This is helpful for:

● fund comparison

● investor presentations

● reviewing performance history

● Understanding market behavior impact

Two Easy Ways To Search NAV Trends

You can find NAV trends in two ways inside the best mutual fund software.

Option 1 — Search by Fund House (AMC)

This option is ideal when:

● The investor has already chosen an AMC

● Or you want to analyse funds from a specific fund house

You simply:

1. Select Fund House (AMC)

2. Search and select the scheme name

3. Choose NAV start date

4. Choose NAV end date

Example:

● ICICI Prudential Business Cycle Fund – Growth

● NAV trend from 01-Jan-2020 to today

Once selected, the software instantly shows:

● NAV trend chart

● historical values

● movement patterns over time

No manual downloading, no spreadsheets.

Option 2 — Search by Asset Category

Sometimes investors ask:

● “How have hybrid funds behaved over time?”

● “Show me how equity vs debt moved.”

● “What about commodity funds?”

In that case, you don’t need to remember AMC names.

Just select Asset Category, such as:

● Equity Funds

● Debt Funds

● Hybrid Funds

● Commodity / Others

Then:

1. Select your preferred category

2. Search and choose the scheme

3. Select NAV start date

4. Select NAV end date

You immediately see the trend for the chosen period. This is useful when you’re comparing:

● categories

● strategies

● risk levels

rather than specific AMCs.

Graphical NAV Trend — Why It Matters

A visual graph helps you:

● show volatility clearly

● identify sharp corrections or rallies

● explain market cycle behaviour

● demonstrate fund recovery capability

● simplify conversations with clients

For investors, a chart is easier than numbers. Instead of saying: “NAV fell in 2020 and recovered later”. You can show the dip and recovery visually, and trust is built instantly.

How NAV Trends Help MFDs in Real Life

NAV trend analysis allows you to:

● Explain risk and volatility

● Set realistic expectations

● Understand fund behaviour in crises

● Compare multiple schemes

● Decide SIP vs lump sum timing historically

● Identify long-term wealth creators

Final Takeaway

Yes, the best software makes it extremely easy to view NAV trends for any mutual fund scheme using NAV Finder, to analyse funds better, communicate clearly, and build investor confidence.

FAQs

1. What is an NAV trend?

It shows how a scheme’s NAV has moved over time, instead of just the latest NAV value.

2. Can I select custom dates for NAV trend?

Yes, you can select any start date and end date to study historical NAV movement.

3. Can I search NAV trend only by AMC?

No — you can search by Fund House (AMC) and Asset Category (Equity, Debt, Hybrid, Commodity, etc.) both.

4. Why is NAV trend useful for MFDs?

Because it helps you analyse volatility, explain fund behaviour, compare schemes, communicate clearly with investors, and support investors with visuals rather than just numbers.

Comments

Post a Comment