Does Mutual Fund Software Allow Auto File Request and Upload for the Brokerage Module?

Brokerage management is one of the most important parts of your business as an MFD — and also one of the most time-consuming.

Every month, you request brokerage files from RTAs, wait for them to be generated, download them, upload them manually into software, reconcile, track gaps, and verify numbers. And if there is a delay or a missed upload, your entire brokerage reconciliation gets pushed back.

This is exactly why auto-file request and auto-upload inside mutual fund software is a big relief for distributors.

Let’s talk about how this works and why it matters to your practice.

What is Auto File Request and Upload in the Brokerage Module?

Auto file upload simply means:

● You don’t have to manually request brokerage files every month

● You don’t have to manually upload brokerage files into the software

The mutual fund software for distributors itself:

● automatically requests brokerage statements from RTAs

● downloads them on schedule

● uploads them into the brokerage module

● makes the data instantly available for analysis

This typically applies to both major RTAs:

● CAMS

● KFinTech

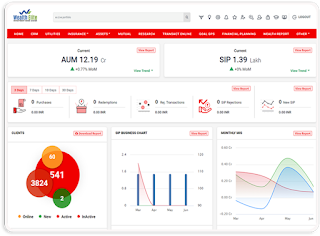

So instead of logging in to multiple portals, downloading multiple files, and uploading them again into your system, everything happens automatically in the background with REDVision Technologies.

How Often Does Auto Upload Happen?

In many modern back office software systems, brokerage files are:

● automatically requested

● automatically uploaded

Every month, usually on a fixed date. For example: brokerage files are auto-requested and auto-uploaded around the 16th of every month

This means you are always up to date without doing anything manually.

Why Auto File Upload Matters for MFDs

1. No more manual downloading and uploading

Earlier, you had to:

● log in to each RTA

● download brokerage files

● save them securely

● upload them to your software

Now the software handles the full cycle automatically.

This saves hours every month — especially for larger MFDs handling high transaction volumes.

2. Fewer errors and missed uploads

Manual work always brings risks:

● wrong file format

● missing months

● incorrect ARN upload

● duplicate uploads

Auto uploads reduce:

● human dependency

● operational errors

● missing data gaps

Your brokerage records stay complete and consistent.

3. Faster brokerage reconciliation

Once brokerage data is auto-uploaded, you can:

● View brokerage for the month instantly

● Compare committed vs received brokerage

● Verify shortfalls quickly

● Track unpaid or delayed amounts

This makes reconciliation faster and far more accurate.

4. Better cash-flow visibility

Brokerage is your income.

With auto uploads:

● no waiting for delayed files

● no reconciling weeks later

● real-time visibility of earnings

This helps you:

● plan expenses

● track business growth

● forecast revenue better

5. Scales effortlessly as business grows

Manual uploads may work when you have:

● few clients

● low transaction volume

But once you grow:

● more ARN codes

● more brokerage lines

● more RTAs and schemes

Manual work becomes impossible to sustain. Auto file upload scales with your growth, without hiring more back-office manpower.

Final Thoughts

Auto file request and upload inside the brokerage module of wealth management software is not “just another feature”.

It directly impacts time saved, effort reduced, accuracy improved, compliance maintained, and revenue visibility enhanced.

In short, it allows you to focus on growing AUM and clients instead of doing routine back-office work. Software is no longer only about portfolios and reports. It is now about automation, operational efficiency, and smarter brokerage management.

FAQs

1. What is auto file request and upload in the mutual fund software?

It is a feature where brokerage files from RTAs are automatically requested and uploaded into your brokerage module without manual downloading or uploading by you or your team.

2. Which RTAs are supported for automatic brokerage upload?

Auto upload generally supports CAMS and KFinTech brokerage files, covering the majority of mutual fund transactions.

3. How does auto upload help MFDs in day-to-day work?

It removes repetitive tasks like downloading and uploading files, reduces human errors, speeds up reconciliation, and saves significant time every month.

4. Is this feature useful for brokerage reconciliation?

Yes. Once files are auto-uploaded, you can directly compare expected vs received brokerage, analyse income sources, and check payouts without waiting for manual data processing.

Workers Comp Insurance for Staffing Agencies Chicago, IllinoisRedvo offers reliable Workers Compensation insurance and PEO solutions for staffing agencies, home health care providers, and small businesses nationwide.

ReplyDelete