Is Mutual Fund Software in India Ready for Millennials and Gen Z Investors?

Millennials and Gen Z are changing the way India invests. Unlike earlier generations, they prefer mutual funds and stocks over traditional assets like gold or real estate. But they also expect everything—mutual funds, equities, FDs, insurance, IPOs, loans—under one roof.

And if that’s not available? They quickly switch to direct platforms that offer ease, speed, and a mobile-first experience. To keep up, many Mutual Fund Distributors are now turning to mutual fund software in India, not just to retain investors, but also to serve them better.

But here’s the real question: Is the software ready for this new generation of investors? Let’s find out.

What Do Young Investors Expect Today?

Millennials and Gen Z investors are clear about what they want:

One App for All Investments

They don’t want to manage separate platforms. One place for mutual funds, stocks, FDs, loans, insurance, and more.

Real-Time Tracking

They want to see how their money is growing—anytime, anywhere.

Mobile Access

Everything must work smoothly on their phones.

Smart Alerts

They need reminders for SIP dues, FD maturities, insurance premiums, and more.

Simple Reports

They want clean, shareable reports they can send to their CAs for tax filing.

How Software Meets Their Needs

1. Multi-Asset Access

Modern mutual fund software for IFA like that offered by REDVision Technologies supports:

● Mutual Funds

● Equity & IPOs

● Fixed Deposits

● Loans Against Mutual Funds

● P2P Lending

● Life & General Insurance

This gives investors complete financial control under one login.

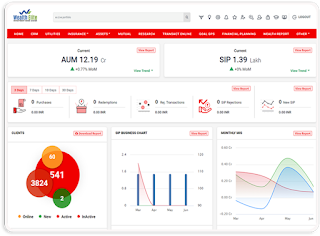

2. Easy Portfolio Tracking

Investors can track:

● NAVs and returns

● SIP performance

● Asset allocation

● Equity holdings

Everything is displayed in real-time, in a simple, clean dashboard.

3. Mobile Apps for On-the-Go Investing

Most software providers now offer dedicated mobile apps where investors can:

● Invest or redeem instantly

● View portfolio performance

● Download statements

● Get updates and alerts

Perfect for the mobile-first generation.

4. Timely Alerts & Notifications

Automatic alerts are sent for:

● SIP due dates

● FD maturity

● Life and health insurance premiums

● Goal reviews

● Tax-saving deadlines

It keeps investors informed, without manual follow-ups.

5. Tax-Ready Reports

At tax time, software offers:

● Capital gains statements

● Investment summaries

● Tax packages (ready to share with CAs)

This removes the burden of tracking documents across platforms.

6. Goal-Based Investment Tools

Many young investors invest with goals in mind. Software offers:

● Goal mapping tools

● Progress tracking

● Automated suggestions to stay on track

This turns financial planning into a meaningful journey.

Conclusion

India’s software is no longer just a back-end tool. It’s a complete investor platform that’s ready for the fast, digital-first world of Millennials and Gen Zs, and it helps MFDs serve modern investors while staying relevant and future-ready.

Final Thoughts

If you’re an MFD still relying on old systems, it’s time to upgrade. Today’s investor expects more, and the right software helps you deliver exactly that.

Because the new-age investor is already online. Are you ready to meet them there?

Comments

Post a Comment