What Are the Different Calculators Available in Mutual Fund Software?

Calculations are at the core of investing. If not done properly, they can hurt your investments. Mutual Fund Distributors (MFDs) often face the challenge of manual, time-consuming, and error-prone calculations, which can slow down their business. This is where mutual fund software for distributors comes into play, offering a range of calculators to streamline and automate calculations.

Challenges MFDs Face with Manual Calculations

1. Prone to Errors: Manual calculations often lead to mistakes, affecting client investments.

2. Time-Consuming: Calculating returns, SIPs, and withdrawals manually takes up valuable time.

3. Inconsistent Results: Manually handling multiple clients makes it difficult to ensure consistent accuracy.

4. Complex Formulas: Some investment calculations require complex formulas, making manual work harder.

5. Reduced Client Trust: Errors and delays in manual calculations can reduce client confidence.

How Does Software Help Ease Calculations?

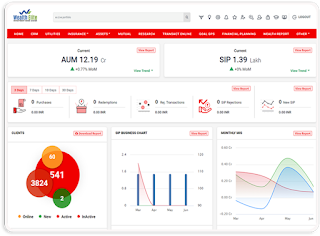

REDVision Technologies understands the importance of calculations and offers mutual fund software for IFA that provides automated calculators that help simplify the process, ensuring faster and error-free calculations.

Key Calculators Available in Mutual Fund Software

SIP Calculator

Calculates future value based on regular investments. Saves time and ensures accurate projections for SIP returns.

Step-Up SIP Calculator

Accounts for increasing SIP contributions, show how small increments can lead to large returns over time.

Lumpsum Calculator

Helps project the future value of one-time investments. Quick and accurate results make planning easier for large investments.

Crorepati Calculator

Guides clients on how much they need to invest periodically to reach a target corpus like Rs 1 crore.

STP Calculator

Helps plan systematic transfers between mutual fund schemes, reducing risk during market transitions.

SWP Calculator

Provides structured withdrawal plans, ensuring retirees or clients withdrawing funds have a steady income without depleting their capital.

Benefits of Using Mutual Fund Software Calculators

1. Accurate Calculations: No risk of human error.

2. Time-Saving: Speeds up the process, letting MFDs handle more clients.

3. Better Client Experience: Improves trust with clear and accurate results.

4. Enhanced Productivity: Allows MFDs to focus on growing their business.

Conclusion

A reliable portfolio management software provides MFDs with advanced calculators that simplify complex calculations, improve accuracy, and free up time to focus on growth. By automating manual tasks, MFDs can better serve their clients and achieve more in less time.

Comments

Post a Comment